When Apple announces a stock split or Microsoft declares a dividend, how does that information reach thousands of financial institutions worldwide in a standardized and reliable format? The answer lies in SWIFT MT564 messages, which form the backbone of corporate actions communication in global finance.

Over the past three decades, corporate actions and SWIFT/ISO messaging have evolved significantly. What began as a static event processing model under ISO 7775 has matured into the more structured and flexible ISO 15022 standard. Even with the emergence of ISO 20022 and its Corporate Action Data Model, ISO 15022 continues to play a critical role in ensuring that issuers, custodians, intermediaries, and investors can communicate efficiently across markets.

At the foundation of this lifecycle is the Notification Message (SWIFT MT564), which provides a consistent data structure for all parties while accommodating market-specific nuances across a wide range of corporate events. Whether processing a straightforward cash dividend or a complex rights issue or tender offer, the MT564’s standardized grouping of event, option, and payment data ensures clarity and precision in message exchange.

However, organizations that still rely on manual interpretation and entry of these messages face operational risks such as delays and errors. As transaction volumes grow, automation becomes critical to achieving straight-through processing (STP) and reducing exposure to these risks.

In the sections that follow, we will explore what SWIFT MT564 messages are, how they are structured, and how automated solutions can enhance efficiency and accuracy in corporate action processing.

What are SWIFT MT564 Messages?

A SWIFT MT564 is a standardized electronic message used to notify market participants about a corporate action on a security, such as a dividend, stock split, rights issue, or merger. It is defined under the ISO 15022 standard and represents the foundation of the corporate action lifecycle, supporting communication across the issuer-to-investor chain.

In practice, it is the official announcement that tells banks, custodians, and asset managers what is happening, when it will take place, and what choices investors may have. It functions as a universal corporate action notification form that ensures all parties across global markets receive the same information in a consistent structure. The MT564’s standardized data fields enable systems to process events with minimal manual intervention, supporting straight-through processing (STP) and reducing operational risk.

MT564 sits at the center of the SWIFT corporate actions messaging framework defined under ISO 15022. It is one of several related message types that together cover the full lifecycle of an event, from initial notification through instruction, confirmation, and status reporting.

| Message Type | Purpose |

|---|---|

| MT564 | Corporate Action Notification (announces the event which can include election reminders and projected entitlements) |

| MT565 | Corporate Action Instruction where the Investor/Account owner provides an election instruction on a specific event. |

| MT566 | Corporate Action Confirmation (acknowledges event payments). |

| MT567 | Corporate Action Status (provides the status of instructions or other event conditions). |

| MT568 | Corporate Action Narrative used to provide free forma information such as ‘Terms and Conditions’ and/or any Operational aspects for an event especially where the MT564 message size limit is a consideration. |

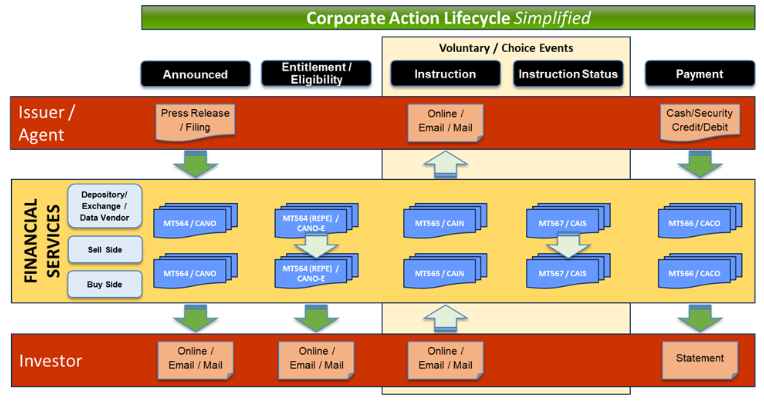

To put this into context, the diagram below shows how corporate action messages flow between issuers, custodians, and investors.

Figure: Corporate Actions Simplified. MT564 notifications form the starting point of the process, while other SWIFT messages such as MT566 and MT567 support later stages, including confirmation and status updates.

This simplified view highlights only the key interactions. In practice, the variety of event types, the number of parties involved, and the need to reconcile updates throughout the lifecycle require sophisticated software solutions to maintain accuracy, timeliness, and efficiency.

MT564 notifications are typically triggered at key milestones, including the announcement date, record date, ex-date, and payment date. Each message includes standardized fields covering the security identifier, event type, relevant dates, and any available options. On a global scale, thousands of MT564 messages are transmitted daily across the SWIFT network, underpinning the automation and accuracy of corporate actions processing worldwide.

Inside an MT564 Message: Structure and Key Components

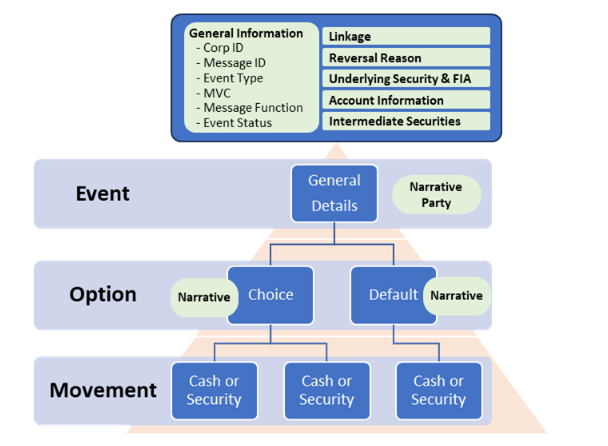

Like a well-organized filing cabinet, every SWIFT MT564 message is built around a defined structure that ensures consistency, validation, and clarity. The message is divided into three primary layers: the header, mandatory fields, and optional fields. Together, these layers form the framework that enables straight-through processing of corporate actions across global markets. The MT564 can also be visualized as a pyramid, with general information at the top and three main event information levels, Event, Option, and Movement, forming the foundation.

Figure: The MT564 pyramid. General information sits at the top, followed by three levels of event information: Event, Option, and Movement.

Before discussing the Event Information levels it is important to note that there are levels that sit above the Pyramid:

General Information – Account Servicer key details concerning:

- Event Type

- Mandatory/Voluntary/Choice nature of the Event

- Event ID

- Event Status

Other Sections:

- Security Information

- Account Details of the Account Owner

- Intermediate Securities – Events with a temporary security e.g. Rights Issue

- Linkage – To other messages / events

Event Level (Details)

Information presented within this level largely covers the details that are general to the event and apply to any and all Options.

- Key Dates, for example:

- Ex-Date

- Record Date

- Effective Date

- General Terms, for example:

- Cash Dividend Event, is the payment a Final or Interim for the Financial Year

- Merger Event, are there Dissenter Rights

- Tender Offer, has the event not met the requisite % of acceptance, therefore, Lapsed

Option Level

The Data Model offers 26 Option Types that either map to an interpretation of the Event as announced by the Issuer / Offeror driven by the Payment types or an Action the Account Owner can perform.

While it is an over simplification of which Option Type is used, Mandatory and Mandatory with Choice will largely fall

into the Payment Type mapping while Voluntary Events will fall into the Investor Action category.

- Payment Types, for example:

- Cash (CASH) – A Cash Dividend is announced with a Rate Per Share, therefore, this Cash Movement Level information.

- A Tender Offer is announced with a Price Per Share, therefore, the Cash Movement will infer the Option Type unless other conditions are offered that would suggest an Investor Action Option is better suited.

- Securities (SECU) – A Stock Dividend with a payment of the same security.

- Cash and Securities (CASE) – Where an Issuer announces a Merger with a payment in exchange for the underlying security for Cash and a quantity of New Securities.

- Investor Action, for example:

- Consent and Tender (CTEN) – The Investor can chose to Tender Securities, usually with an earlier Expiration Date and additional Cash Payment in recognition of consenting to any new terms usually related to the security.

- Exercise (EXER) – The Investor can exercise Warrants into the New Security at the exercise price.

- Oversubscribe (OVER) – The Investor can exercise Rights into a Security at the exercise price.

- No Action (NOAC) – Where the Issuer / Offeror or Account Servicer will indicate that if no Investor response is received then No Action will be taken. Often the default Option Type for a Voluntary event.

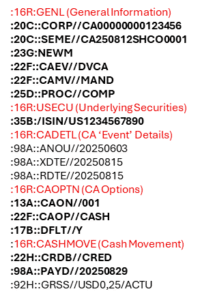

Simplified Example (Anonymized)

Red = The sections of the message

Bold = Mandatory fields

By structuring information into these layers, the MT564 ensures that corporate action notifications are transmitted accurately, validated automatically, and interpreted consistently across the global financial ecosystem.

For more information: https://www.iso20022.org/15022/uhb/finmt564.htm

Corporate Action Types Handled by MT564 Messages

MT564 notifications can represent a wide range of corporate action events, from routine dividend payments to complex reorganizations. Grouping them by complexity helps illustrate how these messages are structured and applied in practice within the ISO 15022 Corporate Action Data Model.

Straightforward Events

These events are the simplest to process and generally fall under the Mandatory category. They occur automatically and require no investor election. In most cases, the MT564 contains one option marked as the default:

These events require only a single MT564 since the information is static once announced and no instructions are expected from investors.

Choice-Based Events

These are Mandatory with Options (Choice) events. The corporate action will occur regardless of investor response, but shareholders can choose how they would like to receive their entitlement. The MT564 includes multiple options, with one identified as the default:

Because multiple outcomes are possible, the MT564 includes detailed event, option, and movement-level data, as well as narrative fields describing election deadlines, standing instructions, and default options.

Voluntary Events and Complex Reorganizations

Voluntary events are the most complex and carry the highest operational risk. They depend on explicit investor instruction, making the Option Level of the MT564 critical. These include tender offers, consent solicitations, and Dutch auctions. The message must capture key elements such as expiration deadlines, response cutoffs, withdrawal rights, price ranges, and prorated allocations. Due to the nature of the event and updates provided by issuers several MT564 messages can be sent as the event progresses.

These variations highlight how market practice and regulation, guided by initiatives such as the Securities Market Practice Group (SMPG), influence how MT564 messages are structured and interpreted across jurisdictions.

Events and Market Practice Considerations

The ISO Data Model offers over 60 Corporate Action Event Types with an additional category for whether an Event is Mandatory, Voluntary or Mandatory with Options (Choice). Events can fall into one category, for example a Cash Dividend would normally be a Mandatory Event whereas a Merger could be Mandatory or Choice Event.

Recognizing that the Event Type will provide the distinctive Corporate Action that can drive expectation of what information will be provided we can first consider some principles for the Event as determined by the Event categorization and the presence of Options.

Mandatory Event

In these cases the Number of Options will be/should be limited to (1) One which will also include a Default Flag set to ‘Yes’, or (0) None.

A Cash Dividend, as announced by the Issuer, will provide information to populate:

- Event Level: Record Date

- Movement Level: Rate Per Share + Currency and Payable Date

To support the MT564 the Asset Servicer will incorporate the Mandatory Information which in this case would be:

- Option Level: Option Type (Cash) and Default Flag (Y)

A Company Name Change that is not facilitated by a Security Identifier change and/or Accounting transaction can be limited to Event Level only without the need for either Option or Movement Levels:

- Event Level: Effective Date

To support the MT564 the Asset Servicer will incorporate the additional Information which in this case would be:

- Event Level: Change Type (NAME) as the Event Type (while once was identified as a Name Change) has been normalised under an Event Type of ‘Change (CHAN)’

Mandatory with Options (Choice)

These events enable an Investor to make a decision about what payment they wish to receive on an event that will occur regardless of their election. In these cases, such as a Stock Optional Dividend or Merger with Options, the number of Options should exceed (1) One with an Option designated as the ‘Default’ in case no election is made.

Similarly to the Mandatory Event example the event information will be expected at the Event Level, Option Level and Movement Level with the possible inclusion of ‘Narrative’ to support the reason why more than one Option is presented and if ‘Standing Instructions’ will be implemented, if on file.

Voluntary Event

The more complicated and riskiest events fall within the Voluntary Event category. In these cases the Option Information takes on greater importance. Certainly Event and Movement Level details are expected but additional considerations to be aware of include:

- Option Level: Important Terms for a Investor to be aware of that impacts an Instruction back the Issuer, such as:

Expiration Deadline and Response Deadlines, including updating an Event and sending a Replacement MT564 if the offer is extended

Instruction Conditions, for example:

- Providing an acceptance price for a Dutch Auction or acknowledge that the Offeror’s price will be acceptable to the Investor

- Can an Instruction be withdrawn once submitted

- Whether an event is prorated should an Option be over elected

Market Practice

To facilitate updates to the ISO Data Dictionary and SWIFT Maintenance the Securities Market Practice Group was formed to bring representatives of global markets together and determine how best to improve the ISO Standards that can either be generally used or specifically used by one market.

In the case of a Tender Offer (TEND) many countries may see such an Event Type as Voluntary (VOLU) while others for example Norway, can also assign a category of Mandatory (MAND) to support a ‘squeeze out bid’, therefore, recognising market differences becomes an important consideration when ingesting or creating a MT564.

For more information: https://www.smpg.info/about-us

How MT564 Processing Works: From Message to Action

Although MT564 notifications may appear technical, they follow a logical sequence from creation to distribution. Understanding each step of the workflow highlights how corporate action data is transformed into usable business information.

Step 1: Message Creation and Sending

Corporate actions begin with the issuer, which announces an event through filings or press releases. A custodian, depository, or registrar then creates the MT564 to formalize the announcement. For example, in a reverse stock split, the issuer confirms the terms, and the custodian generates the MT564. Messages are transmitted securely through the SWIFT network, usually within hours of the announcement.

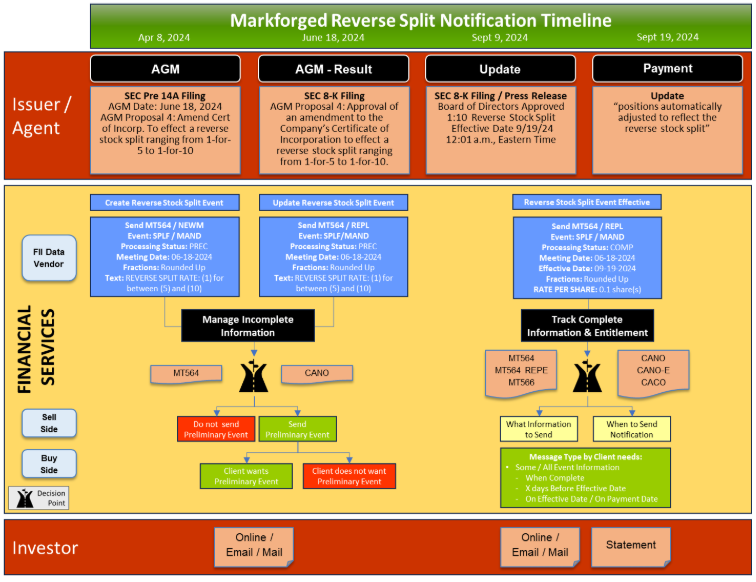

The diagram below shows how a reverse stock split, such as the Markforged event, is communicated from the issuer through custodians and onward via MT564 notifications.

Figure: Markforged Reverse Split Notification Timeline. The diagram illustrates how corporate action details move from the issuer to custodians and investors using MT564 messages.

Step 2: Receipt and Initial Processing

On receipt, financial institutions capture the MT564 in their processing systems. The first task is validation, ensuring that all mandatory fields are present and consistent. If errors are detected, the message is rejected or flagged for review before moving forward.

Step 3: Data Extraction and Interpretation

The structured SWIFT fields are then parsed into usable business data. Systems match the event to existing security identifiers and highlight unusual conditions. For instance, in a tender offer, the MT564 may specify minimum acceptance thresholds or deadlines that require close monitoring.

Step 4: Downstream Distribution

Once validated and interpreted, the information flows into downstream systems. Portfolio accounting platforms update positions, client communications are generated, and regulatory reporting requirements are met. Typical timeframes can range from same-day updates for simple dividends to several weeks for complex reorganizations.

This step-by-step process ensures that MT564 notifications move smoothly from issuer to investor, enabling consistent and efficient handling of corporate actions.

Building upon the review of a Corporate Action Event Notification with a simple Reverse Stock Split we can recognise a number of important considerations that the Financial Market Place needs to consider in order to provide the most appropriate level of service as part of the Issuer to Investor chain.

A Simple Corporate Action Model

Issuer

The below example highlights the information presented by the Issuer, in this case through Regulatory Filings and Press Release. Currently there is little in the communication flow that the Issuer needs to standardise therefore, interpretation of the event initially lies with the Depository and Exchange.

Data Vendor

In this example, a 3rd Party (for example FII) will often act as an independent source of information that can be timelier and communicate in a standardised form to enable a structured initiation of the upcoming Corporate Action.

Sell Side and Buy Side

Whether on the Sell Side or Buy Side the party has a number of factors to consider and manage that either are determined by their own Operating Practice and Responsibilities as well as accommodating Client preferences and accounting for the Corporate Action.

Managing, tracking and accounting for these considerations can be complex to recognise and solve for, such as:

- Stage of the Event: Have a received the event in an efficient and timely manner and how do mange the new and updated details required in order to effectively communicate to my client per their needs and preferences?

- Completion of an Event: Have I received enough information that the event can be correctly accounted for and paid to my clients?

- Communication of an Event: Can I communicate each critical Stage and Status of an event by a means in which my client can efficiently consume the information correctly and timely to meet their needs?

Investor

The Investor’s needs are largely championed by the Buy Side and depending on whether the Investor is an Individual or Institution the needs can be similar or different but a reliance on timely, accurate and accounting is no less important that the other parties within the Financial Services Industry.

A Complex Corporate Action Model

Even with reference to the above Simple Model, we can notice some complexities as a single event may have dependencies on other Event or Actions. In the Markforged Reverse Stock Split the event was dependent upon Shareholder approval at the Annual Company Meeting and subsequently upon approval by the Board of Directors.

Monitoring and tracking the events individually to present a clear and complete picture to the Investor creates greater management of the Corporate Action Timeline(s) and presenting how events may be related to or dependent upon on and another.

For example, a Tender Offer may offering a number of Options that may apply to different Investor types and locations of the Investor. The Tender Offer may be dependent upon a % of securities being tendered in order for the event to become effective, in which case a Mandatory event may follow to remove any non tendering positions unless held with dissent.

Similarly to the Reverse Stock Split example, the Corporate Action challenge continues to be one of managing, communicating, organising information to ensure all parties have clarity of the actions they can take or are taken on their behalf.

Automated MT564 Processing: The CAAPS Advantage

Processing MT564 corporate action notifications manually is time-consuming and risky. Operations teams must collect data from multiple sources, re-key or reformat information, and reconcile differences across custodians, depositories, and vendors. This creates higher error rates, difficulty managing large volumes, and the risk of missing critical deadlines.

Automated systems such as CAAPS are designed to eliminate these challenges by standardizing how notifications are captured, processed, and distributed.

How Automation Transforms MT564 Processing

- Real-time ingestion and validation: Messages from custodians, depositories, and vendors are captured immediately, with built-in checks against SWIFT rules and ISO market practice.

- Intelligent parsing and data extraction: Structured fields such as event type, key dates, and payment rates are automatically interpreted and matched to internal security databases.

- Customizable workflows: Rules can be configured to handle specific market practices, client requirements, or escalation procedures.

- Integration with existing systems: Data flows directly into portfolio accounting, client reporting, and compliance platforms.

Benefits of CAAPS in Practice

- Faster processing: Notifications that once took hours to review and key in can be validated and distributed in minutes.

- Reduced errors: Automated validation significantly improves accuracy compared to manual entry.

- Cost efficiency: Lower operational overhead and fewer missed deadlines reduce financial and reputational risk.

- Scalable platform: Extends the capabilities of existing legacy software systems without disruptive replacement.

- Adaptable design: A flexible methodology that enables and supports future business growth.

- Flexible solution: Supports the expansion of service offerings to meet individual client and market needs.

By moving from manual workflows to automated MT564 processing, firms gain speed, accuracy, and resilience, ensuring that critical corporate action data is delivered reliably across the issuer-to-investor chain.

Conclusion: Streamlining Your Corporate Actions Workflow

The Corporate Action Lifecyle is a long and complex process that requires accurate, timely communication between many parties. When you also consider the impact of an ever-increasing investor client base as well as supporting Issuers from many markets around the globe, the task of managing Corporate Actions continues to be one of the riskier and more nuanced aspects of the Financial Services Industry.

We have discussed within this article many of the challenges faced from consuming and interpreting information from multiple sources for different types of Corporate Action Events, to monitoring and tracking updates from both the Issuer / Offeror or an Investor’s Election while presenting and receiving information in a manner to efficiently support your own Operational and Client needs.

To help address the needs a strong foundation is crucial to not only the marketplace at large but also your own operating environment.

Key components of this foundation can be found in:

- ISO Corporate Action Data Model supported by ISO 15022 and ISO 20022 messaging and widespread adoption from Depositories, Exchanges, Data Vendors and Custodian Banks.

- Securities Market Practice and Industry Organizations working locally and globally to continue to improve upon the Data Model while accounting for fluid changes occurring within the Securities Marketplace.

- Expertise in Software Solutions that can operate under the Data Model, regardless of format, while managing and communication information that is configurable to your needs and the unique needs of your clients.

Whether your organisation has adopted the ISO Corporate Action Data Model or has questions about which standard to follow, to questions about integration not only with external parties but your own legacy systems and even where does one begin the analysis of improving Straight-Through-Processing (STP), your journey along a new Corporate Action Lifecycle can be start today.